Cash flow data is a key component of the preparation of financial statements used by small businesses.

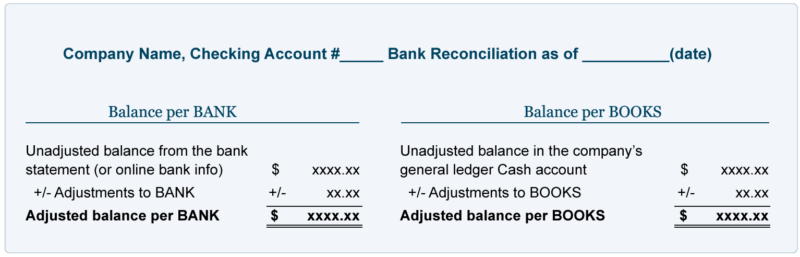

Cash reconciliation is an important part of any business accounting system. It verifies the exact cash flow in a ledger before end of business or at end of a period, before inputting adjustments to revenue or expense. Verification of cash flow provides management with a comprehensive picture of a company’s cash transactions and allows business owners to make effective decisions regarding their cash. Cash flow forecasts are important tools used to determine the amount of cash available for short-term funding, take control of cash management, and reduce financial risk. Without accurate cash flow information, management may be forced to overpay funds to vendors, buy supplies when they are not needed, or invest excessive resources in activities that do not generate revenue.

Most companies use an accounting system called “the double-entry bookkeeping system,” which requires the use of two different books: a “books-and-instructions” bookkeeping system that includes basic transaction records such as purchase and sale transactions; and a “books-only” accounting system that only provides information on the most recent transactions. The double-entry bookkeeping system is susceptible to inaccurate entries caused by human or automated error. Since all transactions in the books must be unconditional, it contains a number of potential problems including reconciliation difficulties. Inaccuracies in the accounting records can potentially have an adverse effect on the entire business. A company’s ability to successfully obtain financing, retain personnel and assets, and manage its business relationships are hindered if it cannot accurately and timely report its financial transactions.

Small business accounting records contain a number of different types of receipts and debits. These include sales receipts, inventory purchases, accrued expenses, gross taxes, and payroll tax. Because many of these transaction types relate to day-to-day cash management, many small business owners find it difficult to reconcile these cash transactions. Incorrect estimates of current accounts receivable or current accounts payable often lead to inaccurate computations of income and expense. In addition, reconciling daily cash flow may prove challenging due to seasonal variations in customer spending. Cash flow errors caused by clerical error or data entry mistakes, therefore, can significantly impact a small business’s cash flow.

Cash flow data is a key component of the preparation of financial statements used by small businesses to obtain financing and other commercial finance. Because revenue represents the primary source of a small business’s resources, it is important to keep track of both revenue and expenditures. This involves the careful tracking of sales, purchases, and all other cash transactions necessary to support normal day-to-day operations. A well-constructed cash flow model should provide a solid picture of all cash flows, including both paid and unpaid balances. Cash flow models are available from many suppliers and can be easily customized to meet the needs of any organization.

Here at TSAT, we are not simply tax preparers. We work with you to provide a 360-degree strategic financial advice, including small business cash flow and reconciliation. We will help you stay ahead of the curve when it comes to cash flow!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING team considers much more than just your taxes!

TSAT’s Services will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

Email: info@tsataccountingsolutions.com or sales@tsataccountingsolutions.com

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

“We want to Amaze our Clients not just serve them”. – Tabitha Smith