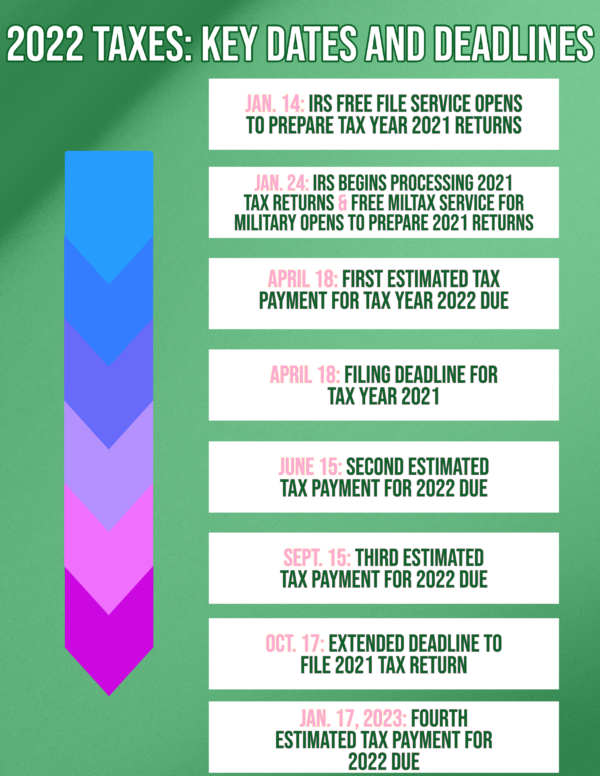

We’re nearly 3 weeks into the new year, and as we look forward it’s time to mark some significant dates for your personal income or small business taxes. See table below for all important dates!

Keep in mind that we are filing taxes for income earned in 2021, even though we file those forms in 2022. To keep confusion to a minimum, tax experts refer to 2021 as the tax year and 2022 as the filing year. Most, but not all, of the deadlines in 2022 refer to tax year 2021.

For 2022, the federal tax deadline has been moved up, this time to April 18, 2022. This is so that it coincides with Emancipation Day in the United States, which is celebrated on April 16. While it’s not widely celebrated in the rest of the country, it is a holiday that’s celebrated in Washington, D.C.

Here’s some interesting facts about this day from our friends at AAPR:

“Because Washington, D.C., observes Emancipation Day on Friday, April 15. By law, the IRS is required to treat D.C. holidays as if they were national holidays for tax-filing purposes. Emancipation Day commemorates the day in 1862 when President Abraham Lincoln signed into law a measure to free enslaved people in D.C. (Adding to the complexity, the actual date of Emancipation Day is April 16, but since it falls on a Saturday this year the holiday is celebrated a day early.)

Making matters more complicated, taxpayers in Maine and Massachusetts don’t have to file until April 19, because those states celebrate Patriots’ Day on April 18. The holiday marks the first battles of the American Revolution in 1775.

Some taxpayers affected by recent natural disasters get extra time to file. Victims of the January Colorado wildfires will have until May 16 to file their federal tax returns. The same goes for victims of the December tornados and flooding in Kentucky.”

However, while the new deadline is still a few months away, it’s still in everyone’s best interest to file as soon as possible. The easiest way to file is through direct deposit.

The IRS begins its 2022 tax season on 24 January, which is Friday this year. Since the due date is a holiday, the IRS moves it up to the next available business day. In this case, the deadline to file your taxes is set to be April 18, 2022. In addition, it is important to note that the District of Columbia is observing Emancipation Day on April 15, so if you live in the city, the IRS can’t require you to file your tax return on this date. The next business day is April 18, so that’s the date you’ll need to make your payments.

Although the first quarter of 2022 is not due until April 18, workers must report their March tips to their employers by April 11. The deadline for filing your 2021 taxes is April 18 for people who live in the District of Columbia. Additionally, military personnel have until June 15 to file their 2021 tax returns. Finally, taxpayers living in the District of Columbia must apply for a four-month extension for tax filing before this date because of the COVID virus.

The IRS tax deadline for the year 2022 is April 18 for residents and April 15 for businesses. If you can’t file on time, you can apply for an extension to receive more time to file. In the meantime, be sure to make your payments by the deadline. If you are a resident, the IRS has the same deadline for businesses as well. This way, you’ll have more time to pay all your taxes.

Source: https://www.aarp.org/money/taxes/info-2022/irs-deadlines.html

Managing the finance, accounting, and bookkeeping aspects of your small business is an absolute necessity. Whether just starting out, a gig worker, or trying to grow and scale outsourcing the CFO position has numerous benefits. Even if you are happy with the status quo, you still need a professional to keep the financial side of things flowing, compliant, and working as an asset to your business. If you’re looking to free up some time in your busy schedule or would like to remove the stress of bookkeeping and financial planning from your to-do list, this could be the time for you to reach out to TSAT!

At TSAT, we know that a great businesses need to operate at high levels of service, accuracy, reliability, and throughput. We also know that the only way to ensure these things are achieved is to develop a comprehensive set of accounting and finance policies and procedures and to regularly train all personnel involved in the management and control of the company’s software. Only by taking steps toward accounting, quality assurance, and finances can a small business accounting department expand its business and improve its profit margins. It takes a little work to make sure that every aspect of small business accounting is running at full capacity, and we are here to help!

Here at TSAT, we are not simply tax preparers. We work with you to provide a 360-degree strategic financial advice, including small business operations and investment guidance. We will help you stay ahead of the curve when it small business or personal investments!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING team considers much more than just your taxes!

TSAT’s Services will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

“We want to Amaze our Clients not just serve them”. – Tabitha Smith