The IRS Sets 2023 Tax Brackets and Deductibles

The IRS has just issued dozens of inflation adjustments to personal income tax brackets and deductions for 2023. The increases come as a result of four decades of high inflation. and the intended changes affect many deductions and credits. In addition, the IRS is increasing the standard deductions. These changes will help to make the tax bill much more manageable.

The IRS has announced that it is making adjustments to the tax brackets in 2023 to account for inflation. These changes apply to the 2023 tax year and are aimed at preventing “bracket creep,” the phenomenon in which a taxpayer’s salary rises to keep up with inflation and pushes them into higher tax brackets. The increase will result in a higher standard deduction for married couples filing jointly and for heads of households. It will also increase the income limits for each tax bracket.

You may be wondering how these changes will impact you. Here are some changes to expect:

Increase in the Standard Deduction

In the largest deduction increase (oxymoronic, I know) since 1985, The new tax brackets will increase the standard deduction for married couples filing jointly by $27,700 and the standard deduction will increase by $13,850 for single taxpayers and heads of household. These adjustments are designed to keep people from moving up a tax bracket simply because their income increased. Inflation-adjusted tax brackets make a huge difference when the price of goods increases.

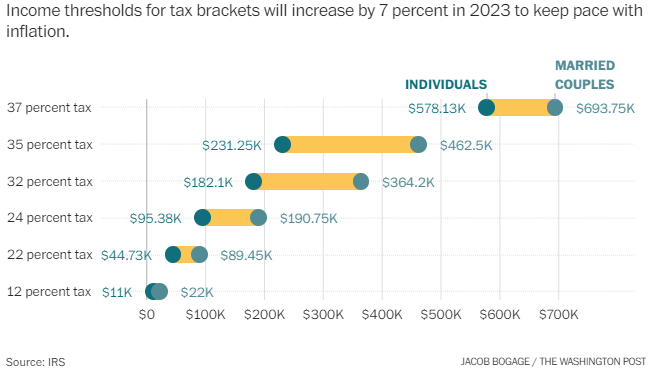

Increase in tax brackets for individuals and married couples

The top tax bracket will remain at 37% for individuals earning more than $578,125 and married couples filing jointly with income more than $693,750. Both of those amounts are up 7 percent from 2022 to track with increases in the consumer price index. This increase will be reflected in paycheck withholding statements for the tax year 2023.

COLA Increase (Cost of Living Adjustment)

In addition, the Social Security Administration announced an 8.7 percent cost-of-living adjustment (COLA) for 2023. The increase will be reflected in tax returns beginning in January 2023.

Increase in child tax credit

The child tax credit is a federal tax break for low-income families. The credit was first introduced as part of the 1997 Taxpayer Relief Act. It can reduce the amount of taxes owed by qualifying families by as much as $2,000 per child under the age of 17. In 2010, the credit was expanded to a maximum of $3,000 per qualifying child, up from a maximum of $1,600 per child. The child tax credit is now refundable and was made available for low-income households.

In 2023, the IRS has set higher tax brackets for the child tax credit. For single filers, the child tax credit will double to $1,600, while married couples filing jointly will be able to take advantage of the maximum earned income tax credit of $7,430. In addition, the tax credit for other forms of adoption will jump from $1,500 to $1,600, allowing higher contributions to these accounts and lower taxable income.

Other Tax Code Adjustments

- The maximum 2023 Earned Income Tax Credit, one of the federal government’s main anti-poverty measures, will be $7,430, up from $6,935 in 2022.

- The annual gift tax exclusion — the maximum amount one person can give another without incurring a tax penalty — will rise to $17,000 from $16,000.

- The IRS will also allow parents adopting a child to shield $15,950 per child from taxes, up from $14,890 in 2022.

You’ve got a lot to focus on, how can TSAT become your Trusted Advisor?

Your Trusted Advisor… At TSAT, we know that a great businesses need to operate at high levels of service, accuracy, reliability, and throughput. We also know that the only way to ensure these things are achieved is to develop a comprehensive set of accounting and finance policies and procedures and to regularly train all personnel involved in the management and control of the company’s software. Only by taking steps toward accounting, quality assurance, and finances can a small business accounting department expand its business and improve its profit margins. It takes a little work to make sure that every aspect of small business accounting is running at full capacity, and we are here to help!

Here at TSAT, we are not simply bookkeepers. We work with you to provide a 360-degree strategic financial advice, including small business operations and investment guidance. We will help you stay ahead of the curve when it small business or personal investments!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING Trusted team considers much more than just your taxes!

TSAT’s is your Trusted Advisor and will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

- Fill out the Qualification Questionnaire for a full 1 hour CFO Consult!