Does Josh the builder get a 1099-MISC or 1099-NEC?

Contract work has grown consistently over the last decade. A business guide to sending out 1099s for contractors is one of the most important tax implications for a small business we can think of. The tax laws for contractors can be very complicated for small businesses. This is because these contractors are usually considered self-employed, which automatically increases both yours and their tax liability on their income tax return. There are ways that you can reduce this tax liability though.

First, you should always be prepared with accurate records. This means that if the contractor finds any errors with your information they need to report them immediately. Even if it’s an insignificant error, they should make sure that they inform you about it. It is best for them to start preparing early so that they have time to make any corrections before filing their actual tax return with the IRS.

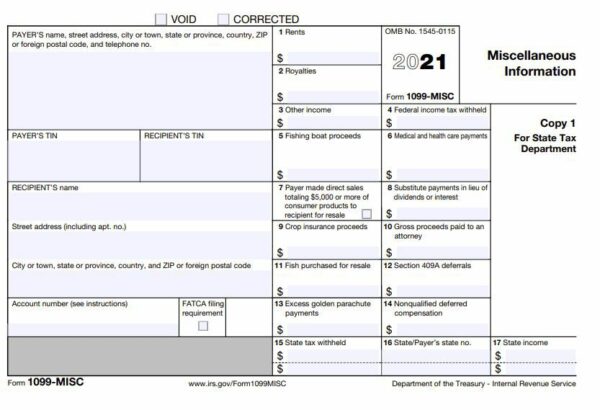

2021 1099-MISC

Another way to make sure that your small business is not responsible for paying a penalty for the incorrect filing of tax returns is to use the services of a tax preparer, such as the amazing TSAT team! Because we know so much about the tax codes, we will be able to give you accurate financial statements. TSAT will also be able to answer any questions you may have about filing tax returns for your contractors and employees.

When you do decide to hire a tax preparer, make sure that you get references from them before you let them help you. You will want to make sure they are knowledgeable, honest, and experienced. Also, find out what kind of payment options they offer. Some preparers only accept debit cards, check, and cash. By using a TSAT you will also protect yourself from penalties and possible fines if you accidentally file the wrong return. Since tax forms are complicated, it is easy to make a mistake when completing them.

TSAT will also help you with:

- What are the differences between 1099-NEC and 1099-MISC?

- What is the deadline to have 1099’s sent to your 1099 employees?

- What are the consequences if you do not send your 1099’s out by the deadline?

- How can employees be penalized if you don’t send out your 1099’s by the deadline?

- What can an employee do if the company that they were a 1099 employee for doesn’t send out the 1099 by the deadline?

As you know it can be a good idea to review and reconcile transactions concerning contractors and employees on a regular basis. Find out what you need to do to start sending out tax forms to your business contractors today.

If you are a small business owner looking to grow your business, TSAT’s AMAZING team considers much more than just your taxes!

TSAT’s Services will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

Email: info@tsataccountingsolutions.com or sales@tsataccountingsolutions.com

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

“We want to Amaze our Clients not just serve them”. – Tabitha Smith