Demystifying the Cash Flow Statement: A Comprehensive Guide

Welcome back to TSAT’s Trusted Advising Blog where we simplify the world of finance and accounting for you and your small businesses! Today, we’ll be delving into the world of cash flow statements. If you’ve ever wondered what they are, how they’re calculated, and why they matter, you’re in the right place.

💸💰📈 So, let’s dive in and unravel the mysteries of the cash flow statement! 💸💰📈

What’s a Cash Flow Statement & What it’s used for

A cash flow statement is a financial report that shows the inflows and outflows of cash and cash equivalents for a company during a specific period, usually a quarter or a year. It offers insights into the company’s ability to generate cash and utilize it effectively, which is crucial for operations, expansion, and paying off debts.

As a small business owner, a cash flow statement is an indispensable financial tool that helps you keep track of your company’s cash inflows and outflows. It offers valuable insights into your business’s financial health and assists you in making strategic decisions. Here are some essential uses of a cash flow statement from the perspective of a small business owner:

- Assessing Liquidity: The cash flow statement helps you determine if your business has sufficient cash to cover its short-term obligations, such as paying suppliers, employees, and operating expenses. This knowledge enables you to maintain a healthy cash balance, ensuring your business operates smoothly.

- Evaluating Operational Efficiency: By examining the cash flow from operating activities, you can gauge the efficiency of your business’s core operations. A positive cash flow from operations signifies that your business is generating enough cash from its primary activities to sustain and grow.

- Identifying Investment Opportunities: The cash flow statement highlights your business’s investing activities, allowing you to evaluate the effectiveness of your current investments and identify new opportunities to allocate resources for growth and expansion.

- Monitoring Financing Activities: Understanding your business’s financing activities, such as borrowing, issuing shares, or paying off debt, helps you manage your capital structure effectively and make informed decisions about debt repayment or fundraising.

- Cash Flow Forecasting: Analyzing historical cash flow statements enables you to identify trends and patterns in your business’s cash flows. This information is valuable for projecting future cash flows and planning for potential cash shortages or surpluses.

What Business Activities are included a Cash Flow Statement?

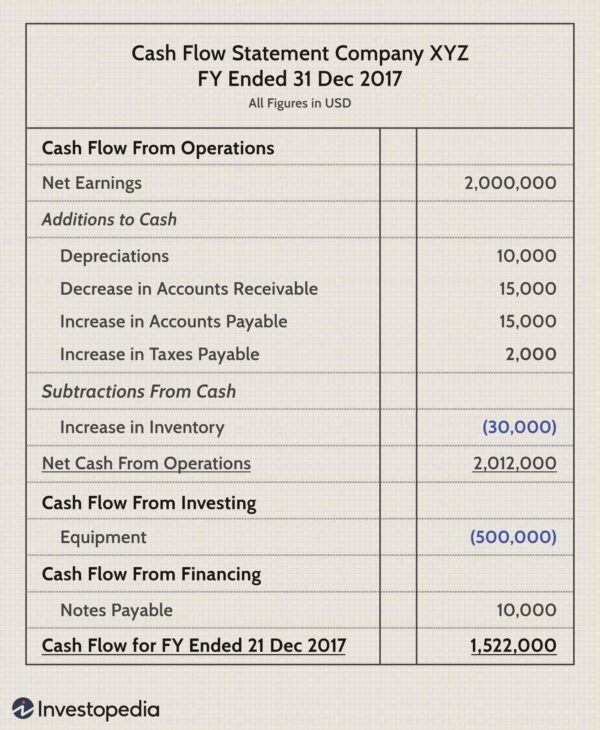

A cash flow statement involves categorizing and summarizing cash transactions into three main sections:

- Operating Activities: This section includes cash transactions from the company’s core operations, such as revenues, expenses, and working capital changes.

- Investing Activities: This section covers cash transactions related to the acquisition and disposal of long-term assets, such as property, plant, equipment, and investments.

- Financing Activities: This section reflects cash transactions involving the company’s capital structure, such as issuing and repaying debt, issuing and repurchasing stock, and paying dividends.

To prepare a cash flow statement, start by gathering data from the company’s income statement and balance sheet for the specific period. Then, classify and record the cash transactions in the appropriate sections, and calculate the net cash flow for each section. Finally, add up the net cash flows from all three sections to determine the overall change in cash for the period.

Two common methods of Cash Flow Statements

There are two methods to prepare a cash flow statement: the direct method and the indirect method.

- Direct Method: The direct method presents a detailed list of cash receipts and payments from operating activities. It involves categorizing cash inflows and outflows by their sources, such as cash collected from customers and cash paid to suppliers. The direct method provides a clear picture of the company’s cash movements but requires extensive data tracking and may be time-consuming to prepare.

- Indirect Method: The indirect method starts with the net income and adjusts for non-cash items and changes in working capital to arrive at the net cash flow from operating activities. It is less detailed than the direct method but is easier to prepare and more commonly used in practice.

Limitations of the cash flow statement

While cash flow statements are essential for assessing a company’s financial health, they do have some limitations:

- The cash flow statement does not provide a comprehensive picture of a company’s profitability, as it focuses solely on cash movements and ignores non-cash transactions.

- It may not accurately reflect a company’s long-term financial health, especially for businesses with irregular cash flows, such as seasonal businesses or start-ups.

- The cash flow statement can be manipulated through aggressive cash management techniques, such as delaying payments to suppliers or accelerating collections from customers, which may present a distorted view of the company’s financial position.

- Comparing cash flow statements across industries or businesses with different capital structures can be challenging, as different businesses have different cash flow patterns and capital requirements.

Despite these limitations, cash flow statements remain an indispensable tool for understanding a company’s liquidity and cash management efficiency!

And there you have it – a comprehensive guide to cash flow statements! We hope this blog post has shed some light on the importance of cash flow statements and how they can be used to analyze a company’s financial health.

Remember, the cash flow statement is just one piece of the puzzle when it comes to assessing a company’s overall financial position. It should be used in conjunction with the balance sheet, income statement, and a Trusted Advisor 🙂 – for a complete analysis. Keep exploring the fascinating world of finance, and stay tuned for more informative blog posts!

💸 Cash is King! Unlock the secrets of cash flow statements with TSAT! Let us become your Trusted Advisor!

Your Trusted Advisor… At TSAT, we know that a great businesses need to operate at high levels of service, accuracy, reliability, and throughput. We also know that the only way to ensure these things are achieved is to develop a comprehensive set of accounting and finance policies and procedures and to regularly train all personnel involved in the management and control of the company’s software. Only by taking steps toward accounting, quality assurance, and finances can a small business accounting department expand its business and improve its profit margins. It takes a little work to make sure that every aspect of small business accounting is running at full capacity, and we are here to help!

Here at TSAT, we are not simply bookkeepers. We work with you to provide a 360-degree strategic financial advice, including small business operations and investment guidance. We will help you stay ahead of the curve when it small business or personal investments!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING Trusted team considers much more than just your taxes!

TSAT’s is your Trusted Advisor and will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

- Fill out the Qualification Questionnaire for a full 1 hour CFO Consult!