TSAT Specializes in Home Healthcare Agency Financial Services!

The healthcare and home healthcare industries are ever-changing. If you operate a home healthcare agency, it is especially important to understand the accounting aspect and have experience in home healthcare financial models. Professionals, such as the TSAT team have the financial acumen required and will make sure you do not run into any problems. We will help you prepare all of your tax reports, keeping all of your accounting records organized and accurate!

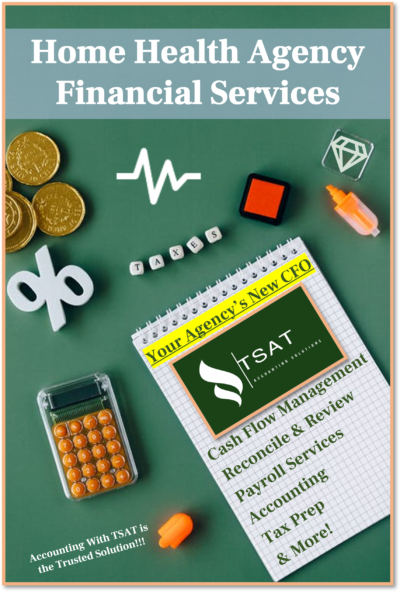

TSAT’s services for home healthcare agencies provide quality financial reviews, accounting, and tax services. Whether you’re looking for general billing services, payroll management, or special services for your home health organization, TSAT’s expertise in these areas will provide you with the best advice and help you achieve maximum results. TSAT will advise you about which tax options to consider, which deductions to use and which credits you may be eligible for. We can also provide you with valuable information on how to structure your home healthcare agency, keep track of payments and assets, and more.

So, what are some accounting and finance aspects of your agency that TSAT will handle?

• Cash or Accrual Accounting system selection

• Revenue Cycle Management

• Reporting and Financial Health Reporting

• Payroll Services

• Depreciation schedules and reviews

• A/R & A/P Management

• Tax Return Prep (For Business, Agents, and Owners)

• And more!

In order to provide excellent accounting and tax services, TSAT knows your home healthcare agency must meet strict requirements. Your agency must have an excellent knowledge of taxation laws, financial reporting standards, and effective systems for securing claims, collecting funds, and filing tax returns. In order to help you meet these requirements, TSAT uses state-of-the-art technology, highly skilled and knowledge teams, auditors, payroll processors and other professionals!

One of the largest areas of concern for Home Health Agencies is payroll. Home healthcare agencies should not rely solely on payroll services to meet their financial obligations. Payroll services are not designed to keep track of taxes and other financial obligations. When combined with proper tax preparation services and appropriate financial reviews, any unnecessary payroll costs will be identified and corrected. TSAT allows you to save money on tax preparation, while streamlining your payroll services.

If you are a new business owner looking to start a home healthcare business or you currently work in the home healthcare industry but you’re not sure where to begin your accounting needs, consider outsourcing your accounting needs to TSAT’s AMAZING team!

TSAT’s Payroll Services will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

Email: info@tsataccountingsolutions.com or sales@tsataccountingsolutions.com

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

“We want to Amaze our Clients not just serve them”. – Tabitha Smith