Small business owners often face a significant challenge in managing their finances effectively. While most entrepreneurs start their businesses with the expectation of earning a profit, many find it challenging to stay afloat in the long run. However, there is a solution: implementing the Profit First formula. In this blog, we will explain all the aspects of the Profit First formula in detail and why it is an excellent idea for small business owners.

What is the Profit First formula?

The Profit First formula is a cash flow management system designed to help small business owners improve their profitability. It was developed by Mike Michalowicz, a renowned business author and entrepreneur. The formula is based on the idea that profits should be a top priority in any business, rather than an afterthought. The Profit First formula involves dividing revenue into various accounts, each with a specific purpose, to ensure that the business owner always knows the financial health of their business.

It involves dividing revenue into different accounts, each with a specific purpose, to ensure that business owners always know the financial health of their business. By allocating funds to different accounts, small business owners can manage their cash flow, track their finances, and make informed decisions about their business.

In contrast, traditional profit calculations focus on the bottom line, which is calculated by subtracting expenses from revenue. Traditional accounting methods typically allocate revenue to expenses first, with profits being the last consideration. While traditional profit calculations can provide insight into the overall profitability of a business, they do not prioritize profits or provide a clear understanding of a business’s cash flow.

The five accounts of the Profit First formula (creating smaller buckets for core functions)

- Income Account:

The Income Account is where all the revenue generated by the business is deposited. This account is also known as the “top line” account. All sales, deposits, and other incoming funds should be deposited into this account. It’s essential to monitor the Income Account regularly to ensure that all transactions are recorded accurately.

- Profit Account:

The Profit Account is where a portion of the revenue, typically around 5-10%, is deposited. This account is used to accumulate profits for the business owner. Profits are the lifeblood of any business, and setting aside a portion of revenue for profits ensures that the business is consistently working towards profitability. By allocating a specific percentage of revenue to the Profit Account, small business owners can prioritize profits and ensure that they are not an afterthought.

- Owner’s Compensation Account:

The Owner’s Compensation Account is where the business owner’s salary is deposited. This account is also used to pay for the owner’s benefits, such as health insurance, retirement plans, and so on. Small business owners often overlook paying themselves a salary, which can lead to burnout and financial stress. By setting up an Owner’s Compensation Account, business owners can ensure that they are paying themselves a fair salary and receiving benefits like any other employee.

- Tax Account:

The Tax Account is where the business owner sets aside funds to pay for taxes. It’s essential to set aside a portion of revenue for taxes to avoid getting caught off guard at tax time. Business owners should estimate their tax liability and allocate a percentage of revenue to the Tax Account each month. By setting aside funds for taxes, small business owners can avoid the stress of scrambling to pay their tax bill when it’s due.

- Operating Expenses Account:

The Operating Expenses Account is where the business owner pays for all the operating expenses of the business, such as rent, utilities, salaries, and other expenses. This account is crucial for tracking the business’s expenses and ensuring that there is enough cash flow to cover expenses. It’s essential to monitor this account regularly to ensure that there is enough money to cover expenses and that the business is not overspending.

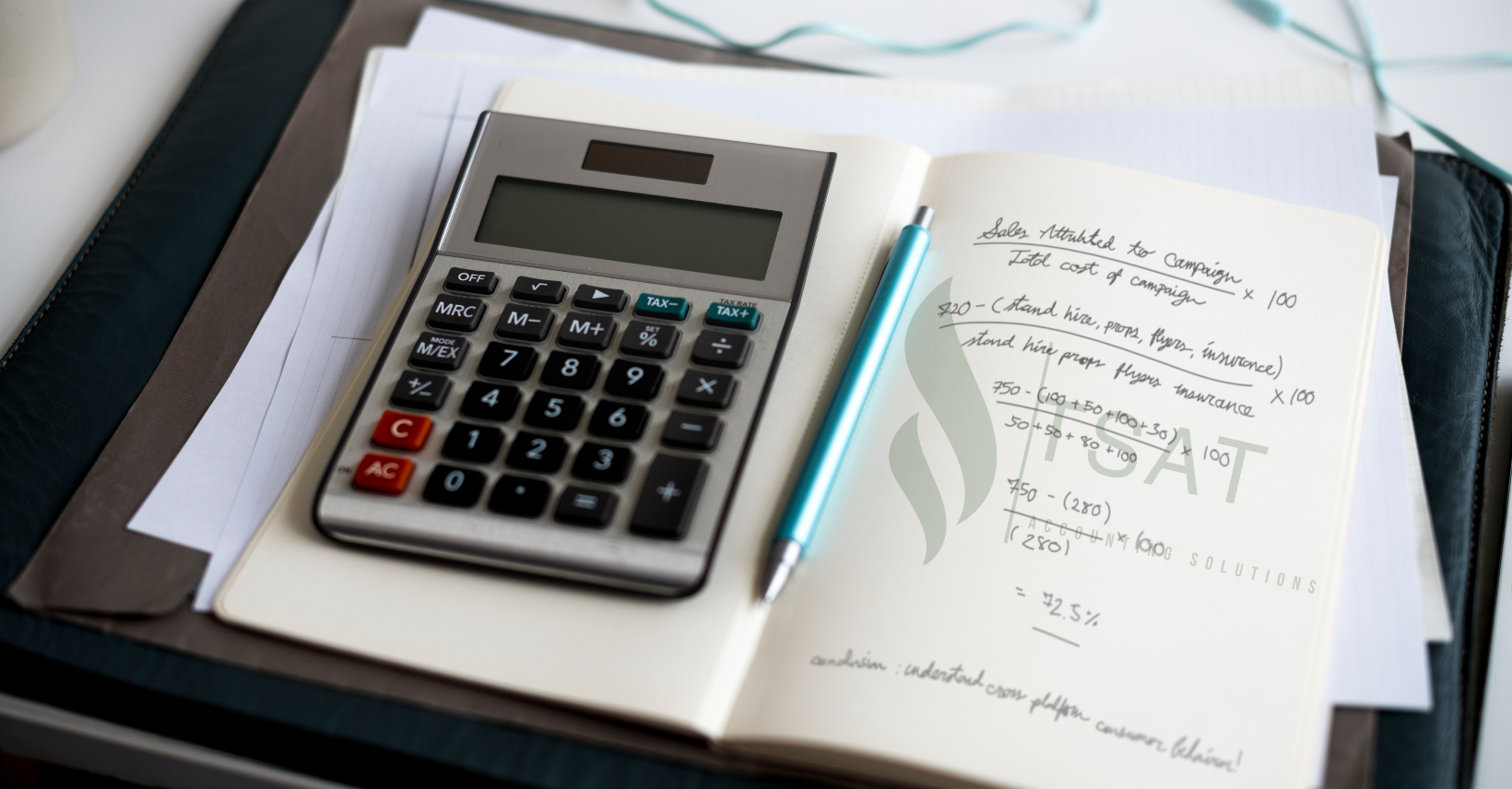

Picture each bank account as a bucket and your cash flow is the gold. Next, we’ll some ways to go over how to determine how much money to allocate into each account together.

Learn more about TSAT’s 2x – 10x CFO Profit Optimization!

Learn more about TSAT’s 2x – 10x CFO Profit Optimization!

CAPs and TAPs

CAPS stands for “Current Allocation Percentages,” and it is a cash flow management system designed for businesses that have been operating for at least a year. With CAPS, a business owner divides their revenue into four accounts: Profit, Tax, Owner’s Compensation, and Operating Expenses. The percentage of revenue allocated to each account is determined based on the business’s historical revenue and expenses. CAPS provides a system for business owners to allocate their revenue effectively, ensuring that they are consistently working towards profitability and reducing financial stress.

TAPS stands for “Target Allocation Percentages,” and it is a cash flow management system designed for startups and newer businesses. With TAPS, a business owner divides their revenue into four accounts: Profit, Tax, Owner’s Compensation, and Operating Expenses. The percentage of revenue allocated to each account is based on a target allocation percentage that the business owner sets. The target allocation percentage is determined based on the business’s revenue goals, and it provides a system for business owners to allocate their revenue effectively as they work towards achieving those goals.

Both CAPS and TAPS are based on the same principles as the Profit First formula, prioritizing profits and ensuring that business owners set aside a portion of revenue for profits, taxes, owner’s compensation, and operating expenses. However, they differ in the way that revenue is allocated. CAPS is designed for established businesses that have a history of revenue and expenses, while TAPS is designed for startups and newer businesses that are still working towards achieving revenue goals. Both systems provide business owners with a clear understanding of their cash flow and help reduce financial stress by ensuring that funds are set aside for expenses, taxes, and profits.

Why is implementing the Profit First formula a good idea for small business owners?

- Increases profitability

The Profit First formula is designed to help small business owners prioritize profits. By setting aside a portion of revenue for profits, business owners can ensure that they are always working towards profitability.

- Helps in managing cash flow

By dividing revenue into different accounts, small business owners can track their cash flow more effectively. They can see how much money they have in each account and make informed decisions about how to allocate funds.

- Reduces financial stress

Small business owners often experience financial stress, worrying about how to pay bills or make payroll. The Profit First formula can help reduce financial stress by ensuring that funds are set aside for expenses, taxes, and profits.

- Helps with decision making

With the Profit First formula, small business owners can make informed decisions about their business finances. They can see how much money they have in each account and make decisions based on that information.

- Simplifies accounting

The Profit First formula simplifies accounting by dividing revenue into different accounts. This makes it easier to track expenses and revenues and ensures that financial reports are accurate and up-to-date.

Implementing the Profit First formula is a good idea for small business owners. It helps increase profitability, manage cash flow, reduce financial stress, aid with decision making, and simplifies accounting. By dividing revenue into different accounts, small business owners can ensure that they always know the financial health of their business and work towards profitability.

TSAT is your Cash Flow Optimizer! Let TSAT become your Trusted Advisor!

Your Trusted Advisor… At TSAT, we know that a great businesses need to operate at high levels of service, accuracy, reliability, and throughput. We also know that the only way to ensure these things are achieved is to develop a comprehensive set of accounting and finance policies and procedures and to regularly train all personnel involved in the management and control of the company’s software. Only by taking steps toward accounting, quality assurance, and finances can a small business accounting department expand its business and improve its profit margins. It takes a little work to make sure that every aspect of small business accounting is running at full capacity, and we are here to help!

Here at TSAT, we are not simply bookkeepers. We work with you to provide a 360-degree strategic financial advice, including small business operations and investment guidance. We will help you stay ahead of the curve when it small business or personal investments!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING Trusted team considers much more than just your taxes!

TSAT’s is your Trusted Advisor and will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

- Fill out the Qualification Questionnaire for a full 1 hour CFO Consult!