Why your small business needs an accurate and up-to-date balance sheet.

Henry Ford said: “the two most important things in any company do not appear on its balance sheet: its reputation and its people.” Nonetheless, a balance sheet is an important financial statement for every small business.

The importance of having an up to date business balance sheet cannot be understated in today’s ever-changing business environment. This is why small business finance tools and resources are vital to keeping small business properly financed and operating at maximum capacity. For those unfamiliar with what such resources are, consider this reaching out to TSAT for a FREE consultation today!

“Business finance” includes the elements of purchasing materials, raw materials, labor, and machinery; selling goods and services; investing in inventory; and making capital purchases. These elements are all intertwined within a well-managed enterprise. Therefore, it is important that a company not only assess its current financial position but also look into potential opportunities for future growth and profit. This is where a well-developed business balance sheet comes into play. A well-prepared business finance management plan will accomplish these goals by ensuring that financing is available to a company in the event of need.

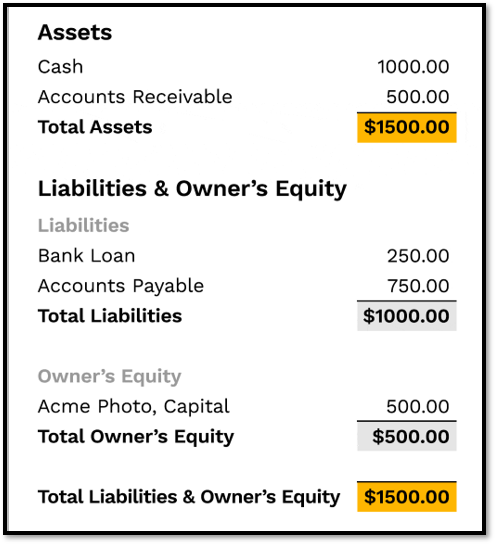

Example Small Business Balance Sheet

A balance sheet, which is often referred to as the financial snapshot of a company, is a summary of all company financial information. The balance sheet will list the current value of all assets, liabilities, and ownership equity. The balance sheet should also list the total current assets, liabilities, ownership equity, and current net worth. A company’s balance sheet is prepared monthly and is used for the purpose of calculating the business owners return on investment, the financial liquidity of the corporation and to monitor the effectiveness of the company’s cash flow operations. All of these numbers will be useful in determining the health and/or loss of a company.

A small business finance management plan will help business owners understand the importance of having an up to date business balance sheet. It will allow small business owners to see at a glance if their businesses are actually running at a loss. As they can see at a glance if there is any unusual activity with their accounts receivable or accounts payable. They can also see at a glance if the cash flow is poor or good.

The most important factor in a small business finance management system is knowing exactly what the owners of financial assets and liabilities are and what they are being used for. There are many ways to determine the value of a business asset or liability. One of the most widely used methods is the cost of capital. Another way is by utilizing the dividends received method, the effect of interest rates and the cash flows generated from various assets and liabilities.

One of the biggest problems that small business owners face when it comes to financial management is knowing their business balance sheet is accurate and up to date at all times. The small business finance system is designed to let owners know what their business assets and liabilities are at any time. Owners should make sure that the business is carrying an adequate balance to meet its short and long term needs. A business can lose money quickly if the balance sheet does not show an accurate balance at the end of the period. This problem will not only have a direct impact on the owner’s profits and bottom line, it will also have an impact on the ability of the business to receive the credit and financing from banks and other financial institutions.

As you know it can be a good idea to review and reconcile transactions concerning your small business finances on a regular basis.

If you are a small business owner looking to grow your business, TSAT’s AMAZING team considers much more than just your taxes!

TSAT’s Services will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

Email: info@tsataccountingsolutions.com or sales@tsataccountingsolutions.com

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

“We want to Amaze our Clients not just serve them”. – Tabitha Smith