Leasing vs. Buying Equipment: Which is Better for Your Small Business?

When your business is looking to acquire new equipment, you face a critical financing decision – should you lease the equipment or buy it outright? While simply purchasing equipment may seem simpler on the surface, leasing comes with unique financial benefits that can be strategic for many businesses. This article breaks down the key pros and cons of leasing versus buying equipment to provide guidance as you make this important asset acquisition decision.

Potential Benefits of Leasing Equipment

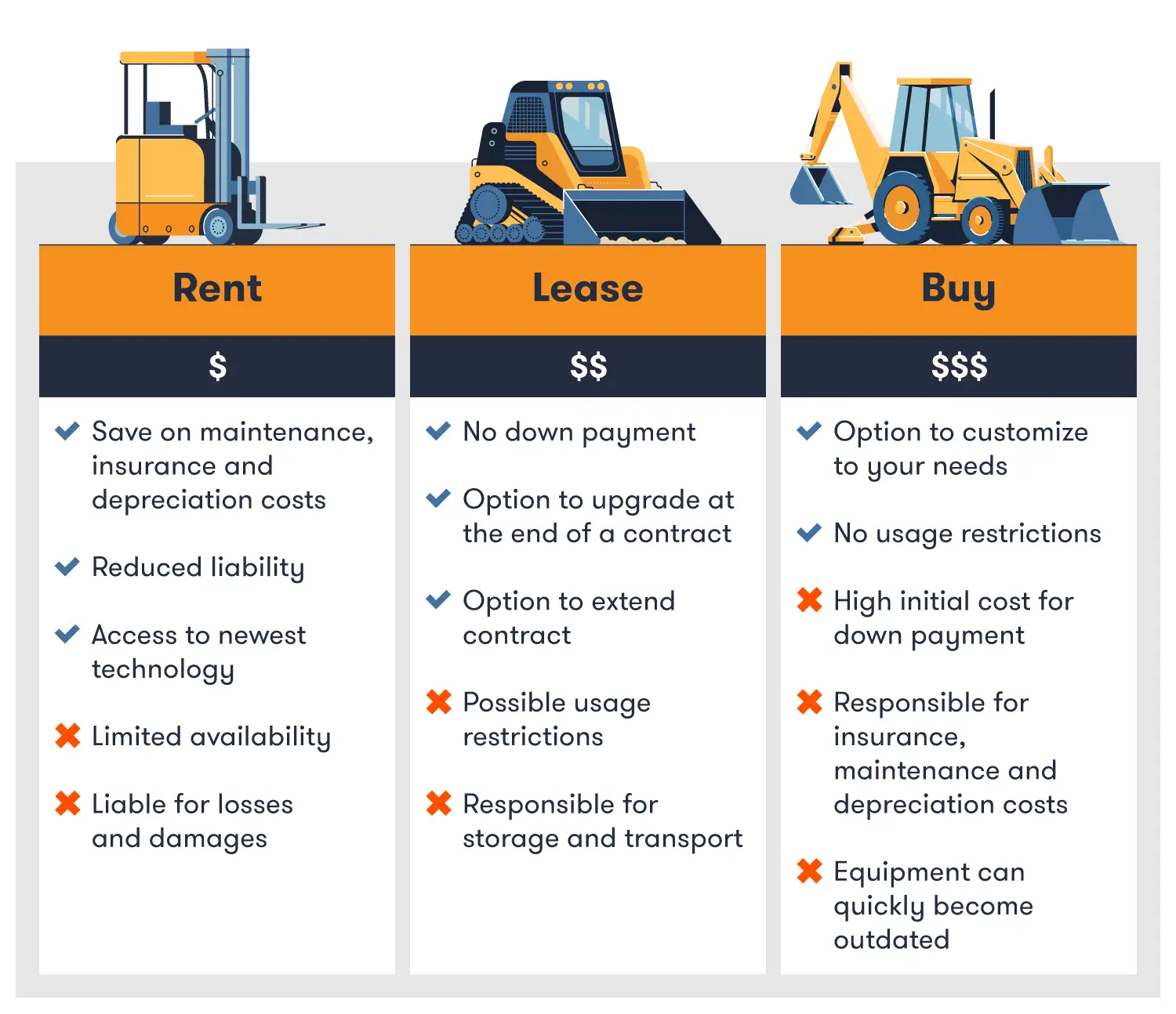

For businesses that want to avoid large capital outlays and preserve working capital, leasing equipment often makes more financial sense than purchasing. Some of the advantages of leasing include:

- Lower Upfront Costs – Leasing generally only requires you to pay the first month’s payment upfront rather than the full purchase price, resulting in significantly lower cash outlay in the beginning.

- Preserves Capital & Liquidity – Since you don’t own the asset, leasing preserves your working capital rather than tying it up in equipment. This frees up cash flow for other business needs.

- Manageable Monthly Payments – Leasing allows you to pay for the equipment through predictable, monthly installments. This can be easier to budget for than a large one-time lump sum purchase.

- Option to Upgrade – When your lease term ends, you can simply trade existing equipment in for newer models to avoid obsolescence. This provides more flexibility than being stuck with owned equipment.

- Potential Tax Deductions – In most cases, equipment lease payments can be written off as tax deductible operating expenses, providing savings come tax time.

In addition, leasing transfers the risks and hassles of equipment ownership – like maintenance, repairs and disposal – to the leasing company. For businesses with evolving equipment needs, leasing can offer strategic financial and operational advantages compared to buying.

When Buying Equipment May Make More Sense

While leasing has its benefits, purchasing equipment is likely the better option in certain situations, such as:

- You Need the Equipment Long-Term – If you plan to use the equipment for 5+ years, ownership can make more sense than continually renewing lease agreements.

- Equipment Will Get Heavy Use – If your equipment will be in extremely high demand, leasing costs over that extended period may exceed purchase costs.

- Your Business Has Excess Capital – Well-established businesses with available capital reserves may opt to purchase assets outright rather than take on recurring lease expenses.

- You Don’t Need the Tax Deductions – If you want to fully depreciate equipment costs rather than deduct lease expenses, purchasing could provide more tax benefits.

- End of Lease Costs Are High – Make sure to analyze the buyout terms, as some leases have expensive fees if you want to own the asset after the term.

Learn more about TSAT’s Trusted Advising!

Learn more about TSAT’s Trusted Advising!

Carefully Assessing Your Options

In most cases, the financially optimal choice between leasing or buying equipment will depend on your specific business’s capital position, operating needs, anticipated equipment usage levels, and the type of asset being acquired. As a small business owner, be sure to thoroughly assess both options – and consult your accounting advisor if you are unsure what makes the most financial sense.

With the right information and strategic analysis, you can make an equipment acquisition decision that maximizes value and financial benefits based on your unique situation.

Photo cred: https://www.bigrentz.com/blog/renting-construction-equipment-beats-buying

Leveraging the Expertise of TSAT!

Our experienced team at TSAT works closely with small business clients to provide advisory services that help optimize key financial decisions like equipment acquisitions. If you are struggling with the lease versus buy decision, we can provide tailored guidance including:

- Crunching the numbers to compare total leasing versus buying costs

- Evaluating your current cash flow and budgets to advise on best financing approach

- Reviewing lease agreements to minimize risks and ensure favorable terms

- Providing ongoing support to analyze future acquisition decisions

Don’t go it alone when making complex asset financing decisions. Contact TSAT today to learn more about how our small business accounting advisors can help you make the right equipment acquisition moves. With the right financial expertise in your corner, you can confidently invest in the assets that will best drive business growth.

🤔Should you lease or buy your biz equipment? We break it down in our latest blog! Get the inside scoop on the ✅ pros and cons to make the smartest 💰 decision for your company! 💡

Your Trusted Advisor… At TSAT, we understand that exceptional small businesses must maintain high standards in service, accuracy, reliability, and efficiency. To achieve these goals, it is essential to establish a thorough set of accounting and finance policies and procedures and consistently train all personnel involved. By letting TSAT focus on you accounting, quality assurance, finances, and provide you with a small business accounting department, you can expand your core competency operations and enhance your profit margins. Ensuring every aspect of small business accounting operates at peak performance requires some effort, and we are here to assist you on this journey!

Here at TSAT, we are not simply bookkeepers. We work with you to provide a 360-degree strategic financial advice, including small business operations and investment guidance. We will help you stay ahead of the curve when it small business or personal investments!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING Trusted team considers much more than just your taxes!

TSAT’s is your Trusted Advisor and will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

- Fill out the Qualification Questionnaire for a full 1 hour CFO Consult