Trusted Advising: Price to Profit – Mastering Pricing Models to Maximize Margins!

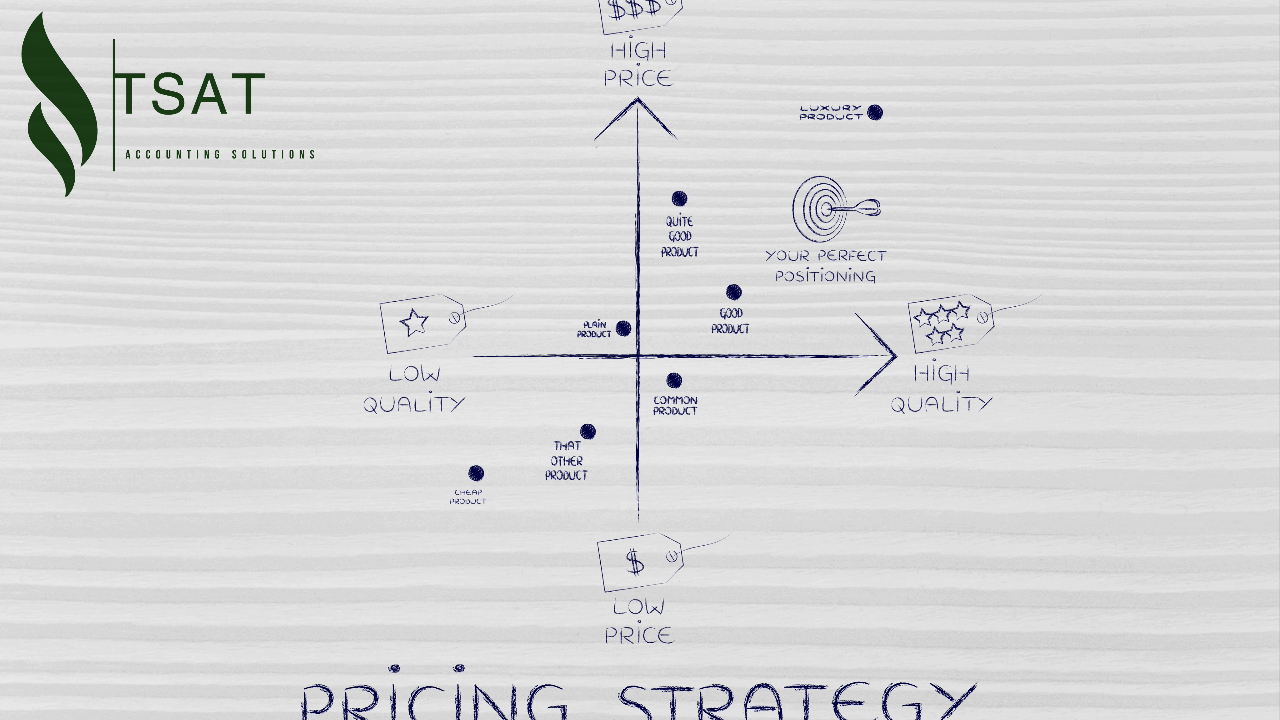

Running a business can be quite the rollercoaster, and one of the most exciting yet challenging parts is figuring out how to slap a price tag on your product or service. That magical number can make or break your venture, affecting everything from your bottom line to how many customers come knocking on your door. Price too low, and you’re leaving cash on the table; price too high, and you might scare away potential buyers. So, how in the world do you find that sweet spot?

Whether you’re in the game of selling your time, products, subscriptions, or something else entirely, the key to success is having a savvy approach to pricing. In this article, we’re going to dive into some pricing tricks and things to think about when you’re trying to figure out what to charge.

Get Your Numbers Straight

First things first, you’ve got to know your financial stuff inside out. That means adding up all the costs it takes to make your product or provide your service – we’re talking materials, labor, the overhead costs, and the profit you want to make. This gives you the rock-bottom price you can go.

Next, get nosy about your competition and what people think your thing is worth. Tools like Price Intelligently and PriceFax can help you peek at what others in your industry are charging. If you’re thinking of going way cheaper than the rest, make sure you can actually do that without going broke. And if you’re thinking of charging a premium, watch out for scaring people off with high prices.

Lastly, do a little testing with your audience. Try out different prices on your website or throw out some limited-time deals. Keep a close eye on how many people bite at each price to see what your crowd really digs.

Pricing Plays

Now, let’s talk about some classic pricing strategies:

- Cost-Plus Pricing: This is where you start with all your costs and then add a percentage on top to get your profit. Pretty straightforward.

- Value-Based Pricing: Forget the costs – this one’s all about how much people think your stuff is worth. It’s about selling the dream, not just the product.

- Dynamic Pricing: This is like a chameleon – it changes in real-time based on things like supply and demand.

- Bundle Pricing: Ever seen those deals where you get a discount for buying a bunch of stuff together? That’s bundle pricing.

- Price Anchoring: This one’s fancy. You set a high initial price to make your discounted price look like a steal.

- Recurring Payment: Think subscriptions – charging a regular fee, usually monthly or yearly, for ongoing services.

Picking the right pricing strategy is like picking the perfect outfit for a special occasion – it takes some trying on and adjusting. Don’t just copy what your competitors are doing; think about your own costs, how much you want to make, and what your audience is into. The right price can really pay off.

Learn more about TSAT’s Trusted Advising!

Learn more about TSAT’s Trusted Advising!

Fine-Tuning Your Approach

Remember, your pricing doesn’t have to be set in stone. Keep an eye on things and tweak your prices when needed. If your costs change, if more people start wanting what you’ve got, or if you’ve got some shiny new features, it might be time to rethink your numbers.

Oh, and one last thing – don’t sell yourself short, but don’t go nuts with your prices either. With the right data-driven plan, you can make a sweet profit and keep your customers smiling.

Need some help figuring out the pricing puzzle for your business? Check out our FREE online resource Vaults. Learn how to set prices that make sense for your business goals and your audience’s wallet. Sign up today and start raking in the profits!

Call TSAT!

Ready to take control of your financial future? At TSAT, we’re here to help you navigate the twists and turns of your financial journey. Our experienced team is dedicated to providing tailored solutions for your unique needs.

Let’s work together to optimize your financial strategy, minimize tax liabilities, and pave the way for your business’s success. Whether you’re a small startup, a growing enterprise, or an individual seeking financial peace of mind, we’ve got you covered.

Don’t let financial uncertainty hold you back. Contact us today to schedule a consultation and discover how we can make your financial goals a reality. Your financial future starts here with TSAT!!!!!!

Stop ❌ leaving $$ on the table! Learn 💡 how to price your products & services for max 💰 profits. Read our new blog post for price optimization tips to pump ⬆️ your margins! 🚀

Your Trusted Advisor… At TSAT, we understand that exceptional small businesses must maintain high standards in service, accuracy, reliability, and efficiency. To achieve these goals, it is essential to establish a thorough set of accounting and finance policies and procedures and consistently train all personnel involved. By letting TSAT focus on you accounting, quality assurance, finances, and provide you with a small business accounting department, you can expand your core competency operations and enhance your profit margins. Ensuring every aspect of small business accounting operates at peak performance requires some effort, and we are here to assist you on this journey!

Here at TSAT, we are not simply bookkeepers. We work with you to provide a 360-degree strategic financial advice, including small business operations and investment guidance. We will help you stay ahead of the curve when it small business or personal investments!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING Trusted team considers much more than just your taxes!

TSAT’s is your Trusted Advisor and will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

- Fill out the Qualification Questionnaire for a full 1 hour CFO Consult