What is the Family and Medical Leave Act?

The Family and Medical Leave Act (FMLA) is a federal law that provides employees with up to 12 weeks of unpaid, job–protected leave per year for certain family and medical reasons. Employees are also entitled to continue their health insurance coverage during their leave. The FMLA applies to all public and private employers with 50 or more employees, as well as to all public agencies and elementary and secondary schools. Employees who have worked for their employer for at least 12 months and have at least 1,250 hours of service during that time are eligible for FMLA leave. Reasons for taking FMLA leave include the birth or adoption of a child, the serious illness of a child, spouse, or parent, or the employee’s own serious health condition. Employees may also take FMLA leave to care for a covered service member with a serious injury or illness. The FMLA provides employees with a job–protected leave of absence for up to 12 weeks per year. Employees are also entitled to continue their health insurance coverage during their leave.

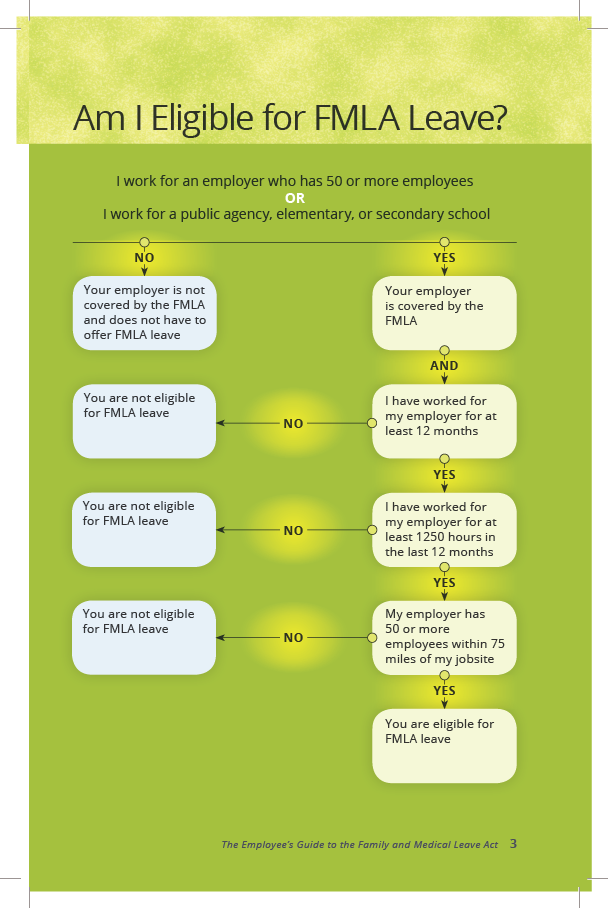

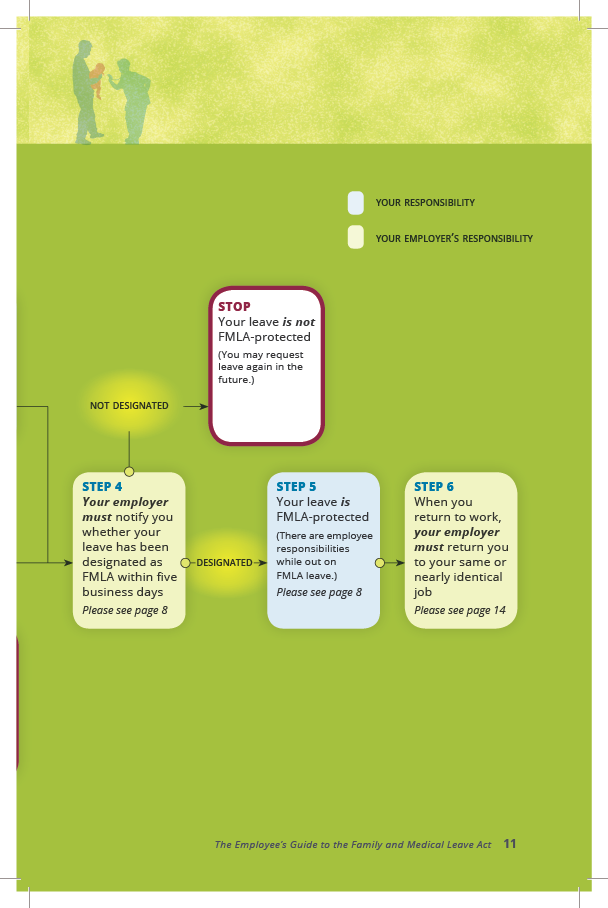

Eligibility Infographic

When Can an Employee Use FMLA Leave?

To be eligible for FMLA leave, an employee must have worked for their employer for at least 12 months, and for at least 1,250 hours over the past 12 months. Employees are also eligible if they work at a location with at least 50 employees within 75 miles.

Here is a high level view of FMLA leave use cases:

–To care for a newborn child

–To care for a newly adopted or foster child

–To care for a spouse, child, or parent with a serious health condition

–To take medical leave when the employee is unable to work due to a serious health condition.

Military Family Leave – The FMLA also provides certain military family leave entitlements. You may take FMLA leave for specified reasons related to certain military deployments. Additionally, you may take up to 26 weeks of FMLA leave in a single 12-month period to care for a covered servicemember with a serious injury or illness.

Read more here for full breakdown: https://www.dol.gov/sites/dolgov/files/WHD/legacy/files/employeeguide.pdf

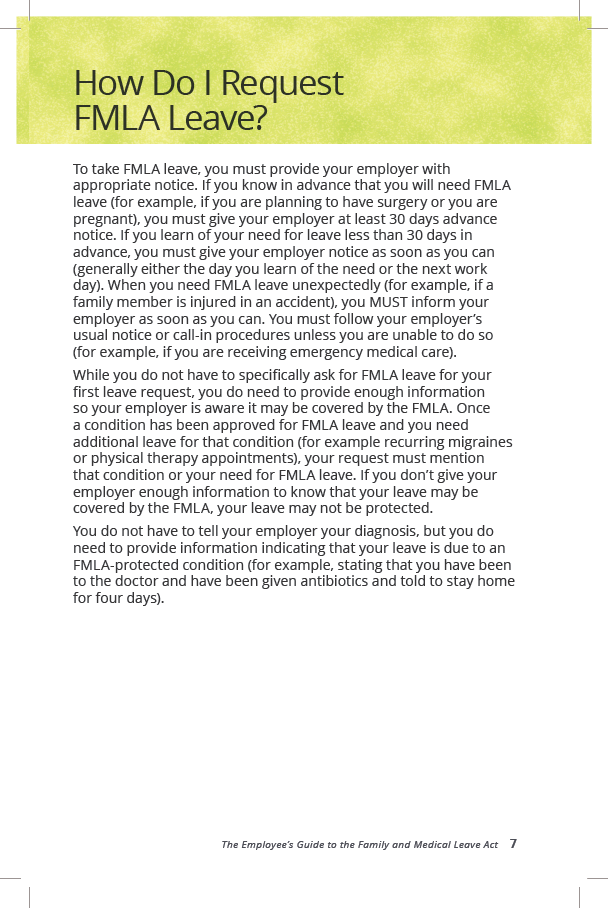

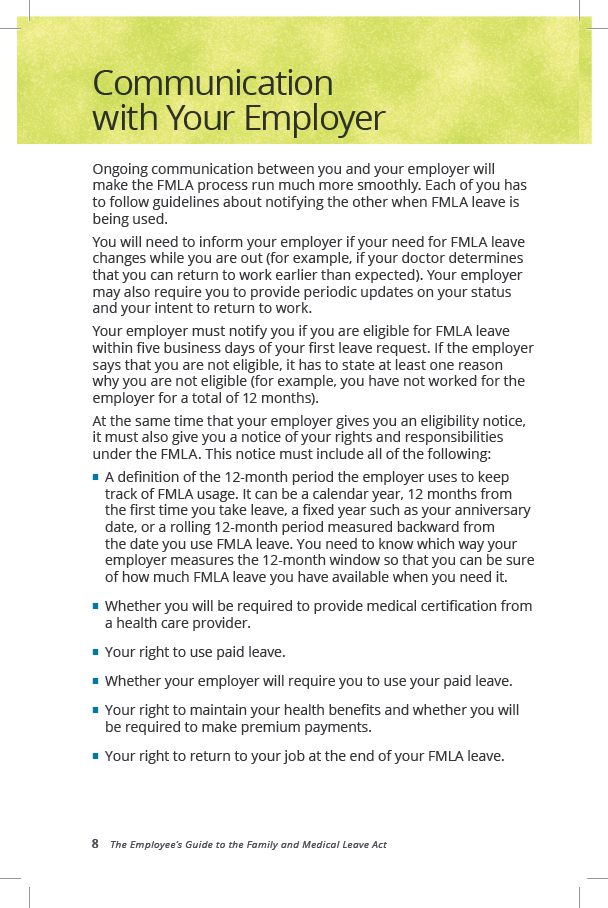

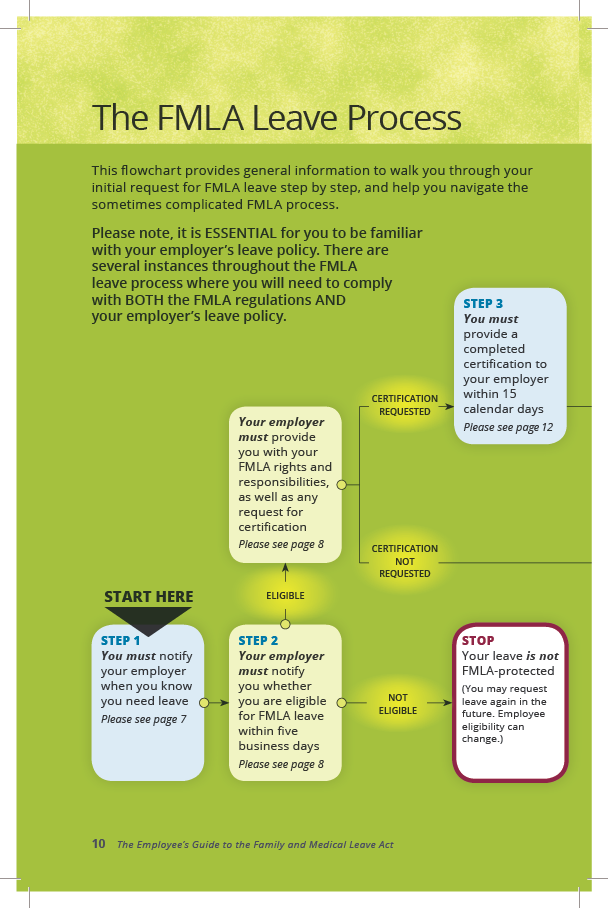

Communication and the Leave Process

For the full breakdown, see: www.dol.gov/whd/fmla

You’ve got a lot to focus on, how can TSAT become your Trusted Advisor?

Your Trusted Advisor… At TSAT, we know that a great businesses need to operate at high levels of service, accuracy, reliability, and throughput. We also know that the only way to ensure these things are achieved is to develop a comprehensive set of accounting and finance policies and procedures and to regularly train all personnel involved in the management and control of the company’s software. Only by taking steps toward accounting, quality assurance, and finances can a small business accounting department expand its business and improve its profit margins. It takes a little work to make sure that every aspect of small business accounting is running at full capacity, and we are here to help!

Here at TSAT, we are not simply bookkeepers. We work with you to provide a 360-degree strategic financial advice, including small business operations and investment guidance. We will help you stay ahead of the curve when it small business or personal investments!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING Trusted team considers much more than just your taxes!

TSAT’s is your Trusted Advisor and will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

- Fill out the Qualification Questionnaire for a full 1 hour CFO Consult!