What is the difference between an accountant, a bookkeeper, and a tax preparer?

(And which one is right for your small business?)

Most business owners we work with are focused on the day-to-day operations and necessities of running their business. All entrepreneurs can agree they are passionate about their undertakings, however not every aspect of running the business is pleasant, some might down right suck! In a study done by TD Bank, over half of all the business owners surveyed ranked bookkeeping as their No. 1 hated responsibility of a business owner.

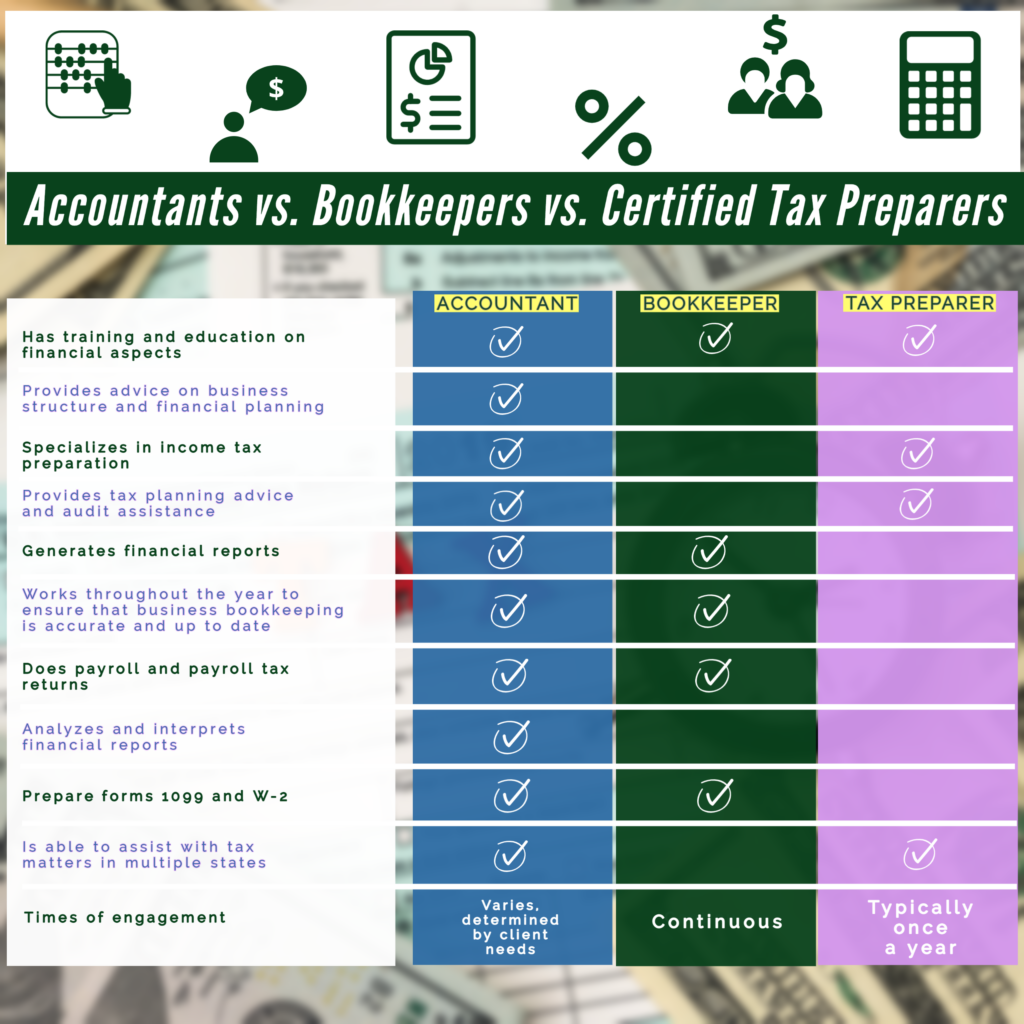

For those owners who decide to outsource, we are often asked the difference between accountants, bookkeepers, and certified tax preparers. All three are financial professionals and share some areas of expertise, however there are some big distinctions. Today, we’re going to help break it down to give you are better understanding of the different roles.

Reference Guide:

While the is certain overlap between the expertise of these types of professionals, there are differences, and each may be the only appropriate solution your financial needs.

Need help deciding which is best for your organization? Or, have more questions? Reach out to us today!

At TSAT, we know that a great businesses need to operate at high levels of service, accuracy, reliability, and throughput. We also know that the only way to ensure these things are achieved is to develop a comprehensive set of accounting and finance policies and procedures and to regularly train all personnel involved in the management and control of the company’s software. Only by taking steps toward accounting, quality assurance, and finances can a small business accounting department expand its business and improve its profit margins. It takes a little work to make sure that every aspect of small business accounting is running at full capacity, and we are here to help!

Here at TSAT, we are not simply tax preparers. We work with you to provide a 360-degree strategic financial advice, including small business operations and investment guidance. We will help you stay ahead of the curve when it small business or personal investments!

If you are a gig worker or small business owner looking to grow your business, TSAT’s AMAZING team considers much more than just your taxes!

TSAT’s Services will let you focus on your business’s core competencies! Whether you have a small business or you need help personally, TSAT can give you HOPE! Call us today!

Phone: (417) 208-2858

- Website: TSAT Accounting Solutions

- Facebook: TSAT Facebook

- Calendly : Quickly schedule a 15 minute call!

- Alignable: Connect with Us on Alignable!

“We want to Amaze our Clients not just serve them”. – Tabitha Smith